CRASHING THE MARKET: Short Selling Shares That Don't Exist For Fun and Profit. (Reposted)

This article was originally published here at Winter Patriot Community blog more than 18mths ago. It is relevant again because of the latest stock market crash under way. Nothing has changed. The 'who's', the 'whats' and the 'why's' are all the same. The Crashes and the Depressions are artificially induced by the people who control the hedge funds, the stock markets, the banks and the governments

This is massive fraud and theft happening in 'real time'.

The only thing that will stop this massive rorting of the economy and the thieving of people's wealth is widespread public exposure

| (Foreword - In the following, the words “stocks” and “shares” mean the same thing and are interchangeable. Similarly, “share scrip” and “share certificates” are interchangeable. I have assumed, too, that you, the reader, are familiar with Credit Creation or the way money comes into existence through banking practice. If you are not familiar with this foundational piece of corruption in Western society, you can read about it here – Warring Worlds pt4b )

If I were to tell you that you had been 'shorted' in a deal you made, most people would ordinarily take that to mean you had been cheated. Being shorted is being dudded. So 'shorting the market' or 'short selling' is a very aptly named practice because basically it is cheating the market, i.e. it's fraud. Too many years ago, I worked for the Melbourne Stock Exchange in Australia and 'short selling' was banned there then for this reason because it involves selling something you don't have and that's illegal most places I know. It's really, really simple. (What the situation is now at the MSE I don't know). (Short selling is now permissible under ASX rules throughout Australia - Ed) Back then when delivery of scrip was a lengthy process it was my understanding, and also of everyone I knew, that the short sellers simply took advantage of this lengthy delay. I heard no one talking about 'borrowing' share scrip (certificates) to deliver and replacing them at a later date. The 'borrowing scrip' idea is a relatively new explanation to my ears, at least, and this explanation is, no doubt, necessary now because of the much faster electronic settlement times. But, it still leaves many questions. So how and why does it operate and how is it all explained away by the industry? The explanation goes like this: a trader considers a stock to be overvalued and expects the price to fall in the near future. So to profit from the situation, the trader borrows shares from someone to sell into the market. When the stock falls in price, the trader buys back the shares to give back to the compliant lender and everybody is happy. That's the story and I don't believe it. I have never believed it because it never made sense; and it still doesn't! Who's going to lend the trader his shares to do this especially when it is perfectly obvious that selling the 'borrowed' shares on the market is going to help depress the price? Why would anyone lend a trader their shares so this 'borrower' could devalue them? It's nuts, of course. So how do they actually pull it off? Until fairly recently, I didn't know. But then I came across the following articles on the net and all was revealed. The conclusions that I will state presently are not stated in the articles but their reality is undeniable once they are highlighted. Here are the articles in question and to save my fingers from Repetitive Strain Injury, would you, gentle reader, go have a Bo Peep at them before reading on? Links- The unknown 20 trillion dollar company Okay, so now you know that most stockholders never get their name on their stock certificates. Indeed, they never even sight their share certificates. They instead have an account with their broker that says they are the 'beneficial owners' of the stock. It's remarkably like the situation of having money in the bank; you have an account in their computer and that's all. The name that is actually on the stock certificates is “Cede & Co” (or similar) as in you cede ownership to Cede & Co. Ironic, no? Cynical, more likely. The similarity with a bank doesn't end there. It seems from all the preceding information that it is reasonable, even unavoidable, to conclude that the short sellers 'borrow' shares in exactly the same way a person 'borrows' money from a bank and both come from the same source; thin air. These borrowed shares are invented and exist temporarily in a double entry type bookeeping system until the short sellers buy back shares to cancel these 'virtual' shares. It is essentially the same method whereby banks lend money that doesn't exist and this extra money has a life until the loan is paid back and the extra virtual money disappears again. This seemingly fraudulent practice has been legitimised through the passing of laws allowing this banking practice. It is called 'Fractional Reserve Banking' overseen in the US by the Federal Reserve Board. The same practice involving shares, stock brokers, the New York Stock Exchange in particular and the Depository Trust Company, is not likewise legal as far as I know. Cede and Co (the registered name on almost all stock) is the nominee company used and owned by the Depository Trust Company (DTC) otherwise known as the Depository Trust and Clearing Corporation (DTCC). What is known for sure, though, is that they are not your friends. So the shares remain in the name of Cede & Co no matter who buys and who sells thus making it impossible to trace particular share certificates through transactions and which shares in the total are pre-existing shares and which ones are the extra 'virtual' ones and which shares disappeared when the short sellers bought back shares to cover those they sold and even the fact that there were extra 'virtual' shares at all. Facilitating this further is the fact that there are no certificates for the shares thus held. They are merely book entries or, more accurately, computer entries. The only thing that changes are the broker's accounts and brokers, as you would have read at the links, are allowed to fudge things in the name of prompt settlement i.e. behave as if they have them in one of their accounts when they don't at all – fraud, in other words; shares created out of thin air. If this were not the case, then shareholders would notice that shares would disappear from their accounts and be replaced at a later date. This doesn't happen, of course, just as money doesn't disappear from your (or anyone else's) banking account when the bank lends someone money. The banks create new 'virtual' money whenever they lend and stock brokers and the DTC must, by all appearances, do exactly the same thing with shares to cover short positions. Getting back to our 'borrowed' stocks and their accommodating owners, we can now see that they can not be borrowed at all but must be newly created. Who can do this? Who are they. They have to be none other the stock brokers who are allowed to do so to a limited degree under the NYSE rules but also the DTC and Cede & Co which is its nominee company that owns most of the real shares on behalf of the 'beneficial' or real owners, the ones that put up the money to buy them. The stocks are sort of held in trust, if you like. Except the trustee is acting against the interests of the rightful owners and without their knowledge whenever they conspire with large short sellers by creating fictitious shares and selling them to deliberately drive down the value of that stock. They can go on creating and selling these fictitious shares until they achieve their desired result; a low share price and driving legitimate owners of stocks that find themselves in financial straits to sell their shares on to a falling market and lose money. These shares are then purchased by the short sellers to cover their sale of fictitious shares at the previous higher prices and the loss suffered by the legitimate owners forced to sell becomes the profit of the short sellers. How is this not theft on a grand scale? As I noted previously, an individual broker can cover for an individual short seller but this individual trader is unlikely to have the clout to crash the market under a wave of selling all by himself. To do that you need numbers and volume and co-ordination. And to cover the stock and share certificates for that necessarily involves the DTC itself because they are the ones that can 'supply' (actually, invent) that amount of scrip to cover the accounts that allows it all to happen. So the owners of DTC, the NYSE and the Fed have to be involved in, if not directly directing, any crash involving substantial short selling into the market. And they can do it any time they like and there's no one to blow the whistle on them. There's no one to say, “Oi, you pinched my share certificates to sell into the market without my permission!” More to the point, there's no one to say, “Oi, there seems to be a whole lot more “Ajax Hot Air Balloons” shares on issue today than there was yesterday!” If anyone on Wall Street wants to maintain that share scrip is really borrowed from existing shareholders, let them name them and show documentation to prove it. Yes, folks, shares are created out of thin air when they are 'lent' just like money is created out of thin air when it is lent into existence. Because no shareholder's account at his brokers is suddenly missing shares to cover the short selling before they are bought back, extra shares have to come into existence for the bridging period. When the shorted shares are bought back (at lower prices), the extra ones, the virtual ones, the thin air ones, disappear into the ether from whence they came leaving no trace for investigators to find (assuming they would ever be appointed and also assuming they would be granted access to the DTC's or Cede & Co's books). Neat, huh? It's just like the banks and your money which they issue and control. So next time there is a major stock market crash, you will know what is going on, who is doing it, how they're doing it and why they're doing it. This leaves the question of what to do about it? Given that these 'wise and honourable men' are the experts followed by the regulators, not much can be expected in the way of reform of these institutions and certainly not of their owners. Public education is the only recourse really, that I can see. So spread the word and tell anyone who will listen that 'short selling' is fraud and why. And if you have shares (and/or have friends who have), insist on receiving your stock certificates in your hand and registered in your name or the name of your own nominee company. If this is not possible, consider selling those shares and buying others where you can be the 'registered owner' and hold actual share certificates instead of being the 'beneficial owner' as suggested in one of the above links. |

The original can be viewed at the link below if you would like to read the comments that the post attracted at the time. Some of the commenters contributed very valuable information

http://www.winterpatriot.com/node/425

Two valuable links were also given. This one provided by McJ-

http://www.deepcapture.com/wp-content/uploads/2009/08/deepcapture-the-st...

and this one from Dave which gives a very insightful overview written by Zeus Yiamouyiannus Ph.D. of our chaotic financial world together with some strategies for survival at the end.

http://www.oftwominds.com/blogmay10/market-unhinged-from-reality05-10.html

Both well worth the time to read if you are interested

Comments

Thanks for this re-post

I was thinking about all this the other day and you know great minds think alike. This is very important stuff and I encourage everyone to read it if they haven't already.

There's a lot to absorb, and it takes a bit of time and effort and concentration, which puts it beyond some people, to be sure. But fortunately our readers here are very keen and bright, and they won't have any trouble with the material.

In a nutshell: We've all been betrayed by the people who were supposed to be protecting us, and that ain't the half of it.

Thanks again, James, and best wishes to all.

Scams and Solutions

Thanks for the endorsement, Winter

So you're to blame! The thought of reposting this only started beating me over the head last night.

Folks, about the only thing that can be relied upon with evil people is that once they hit on a scam or formula that works for them, they will repeat it and repeat it till they bring the house down on everyone's head or some adults step in and stop the lunacy. They're addicts and quite deluded in their grandiosity.

The first step comes from within. We strip all these 'experts' of any authority we have given them in our own minds and take on the responsibility to care for ourselves and our neighbours in any way we can and avoiding the involvement of any 'authorities' including governments. Especially governments. Community groups are far, far better. Some have started and the rest of us are going to have to do this sooner or later anyway. So it's best to start now.

Let us live our lives as free from them as possible so that we stop feeding the beast and they wither on the vine. This is essentially the advice given by the impressively named Zeus Yiamouyainnus in the last linked article.

Again, his article is well worth reading, folks, to get an excellent insight into the massive lunacy we are all surrounded with. It is not necessary to understand every detail (I don't !) but to get the 'flavour' of it will make taking back our authority that much easier and help with the necessary motivation to come up with creative solutions. Thanks go to Dave again for the link.

As Yiamouyiannus says, "In the end, they need us, and we don’t need them."

Once this power is realised, there is no end to the good that can be achieved.

Very good read second time

Very good read second time around, James! I think I'm getting better at this stuff. I should re-read these posts more often.

I should re-read these posts more often.

I had forgotten about the Deep Capture info, it feels like forever ago.

I liked Yiamouyiannus suggestions at the end of his article. I believe you made some similar, excellent suggestions in some of your other posts.

"We can help each other fortify and maintain our health through community programs and “medical tourism”, cutting out health insurance and medical industry parasites. We can set up or join intellectually and socially edifying cultural groups. In short we can exercise civil disobedience, refuse to be stooges, create our own spaces, and and recommit to spend time and energy where our true heart lies, free from the delusional temptations of a corporate-driven reason for life that has shown itself to be both conclusively abusive and unfulfilling.

In the end, they need us, and we don’t need them. This is the only “this life” we are going to have. It’s a lot more adventurous and enhancing to be a cultural creative then a debt slave. So, what are we waiting for?"

I have been thinking a lot about how we survive this and it seems to me coming together as communities and being of service to one another is the direction we need to take. This is not so foreign to me as it may be to others, having been raised on the Canadian prairies. I am old enough to remember the community events and the pooling of resources. This is the only way my grandparents were able to survive the harsh prairie environment. Even when I was younger, our families planted large gardens together (on the family farm) producing enough veggies for three families for several months. We also helped with the annual harvest and went out together to pick wild berries and other fruits, and mushrooms etc. We canned and preserved pretty much everything we got our hands on and I still do. Then there were eggs, milk, cream, beef, pork and chicken, all of which tasted delicious... I could go on.....

When we moved to BC when I was in my late teens, one of the hardest things for us to adjust to was the 'lack of community'. And it wasn't that people here were not friendly just that they didn't come together in the same way to get things done. You know, the "barn raising" mentality. Literally, and I don't think I am exaggerating or being over nostalgic, if others needed help building something such as a barn, or if someone was sick or injured at harvest time etc. the neighbours all pitched in and got it done. Sadly, that lifestyle has diminished over years as the majority of small, family run farms have given way to the modern farming practices. The independent farmer is hard pressed to make end meets.

I guess it comes down to really caring about one another and being willing to give of yourself. Make yourself useful to the universe and then the universe will have a reason to look after you.

This was probably a bit off topic but just where my mind went on this one. It may have something to do with being up to my armpits in garden produce.

thanks James

for the timely repost!

so McJ how do i get up to my armpits in garden produce?

i have a cucumber plant flowering (hooray) but now it is swarmed by white flies and the leaves are turning brown there.

most things i plant get munched by snails & slugs, or attacked by aphids or grasshoppers, or mildew, and of course challenged by fast growing mean weeds.

ok Sorry, i will go look for an organic garden blog now

Cucumbers

The leaves are turning brown because the flies are sucking the life out of them. You can try periodically just hosing them off or spraying them with an insecticidal soap spray.

1 to 2 tablespoons liquid soap (must be a pure soap such as Dr. Bonner's Pure Castille Peppermint Soap and not a detergent)

1 quart water

Combine ingredients in a bucket, mix, then transfer to a spray

bottle as needed.

"so McJ how do i get up to my armpits in garden produce?"

You need a big garden and lots of fruit trees and berry bushes. The secret to good gardening is the soil. The healthier the plants, the better resistant they are to diseases and insect infestations. It takes lots of weeding, pruning and tilling etc. And it helps if you compost. Insects are always a challenge and how you deal with them is dependent on which insects you are dealing with. I unfortunately don't have the greatest soil despite my best efforts. My soil has a high composition of clay and it literally eats whatever I put in it. It is very frustrating. My parents live 5 minutes away from me and the soil in their garden is fabulous, so they produce much more food than me (Drives me crazy but I do get to share in the bounty

The secret to good gardening is the soil. The healthier the plants, the better resistant they are to diseases and insect infestations. It takes lots of weeding, pruning and tilling etc. And it helps if you compost. Insects are always a challenge and how you deal with them is dependent on which insects you are dealing with. I unfortunately don't have the greatest soil despite my best efforts. My soil has a high composition of clay and it literally eats whatever I put in it. It is very frustrating. My parents live 5 minutes away from me and the soil in their garden is fabulous, so they produce much more food than me (Drives me crazy but I do get to share in the bounty  ). Their soil is much more sandy. I should probably dig a truck load of sand into mine but that is just way too much work for my old body. If I had the mula $$$ I would have a bunch of containers built and filled with a top notch soil mix but alas, that is not my lot.

). Their soil is much more sandy. I should probably dig a truck load of sand into mine but that is just way too much work for my old body. If I had the mula $$$ I would have a bunch of containers built and filled with a top notch soil mix but alas, that is not my lot.

My daughter's boyfriend just built me one of these planter boxes. You can get the plans from the site but he just built it by looking at the pictures. I haven't planted it yet (probably too late for this year) but I'm excited to try it out. It is going to be for flowers and I 'm going to attach a trellis to it.

Earth Tainers are a super cool way to garden. I made myself one out of two buckets and I plant herbs in it. (http://i637.photobucket.com/albums/uu91/winterpatriotdotcom/Garden%20201...) You can see the herbs in that picture but you can't really see the bucket set up. There are lots of different ways to make these and once you get the concept you can just come up with your own ideas to make them. Here is a really great design and you could easily use these for your cucumbers.

"ok Sorry, i will go look for an organic garden blog now "

James is gonna come back here and wonder how I managed to turn his post into a discussion of gardening so I better be thinking up some good metaphors. Maybe I need to watch this show again.

re: cucumbers and armpits

hi NJT and McJ,

I was intrigued to say the least at a comment headlined "Cucumber".

No problem with the gardening show. If we called it "Getting Rooted" it would tie it in with the post nicely

(that may be an Oz-centric joke)

Getting Rooted

"If we called it "Getting Rooted" it would tie it in with the post nicely smiling

(that may be an Oz-centric joke)"

Around here "getting rooted" would mean something like "being planted" - as in someone who had their feet planted firmly on the ground (practical, realistic, balanced etc.). It could also mean getting established within a community.

I'm guessing that is not the Aussie take on this. Probably has more to do with planting your seed or a fruit of the loins kinda thing. You Aussies....

You Aussies....

the need to seed

You've got the gist of it, McJ. So you could say we are getting rooted by Wall St.

There was a comedy radio show here (later on teevee) too many years ago and they had a gardening segment called "Getting Rooted".

I'll never forget the day i stumbled on it while travelling in the car one sunny Sunday. It was hilarious. Double entendres all the way and all done in the best deadpan manner. Which is an essential ingredient in Ozzie humour, as you know

gardening and more?

First apologies for dragging this off topic-

James don't know if you read my post from the other day, but, I left a note for you.

You were right on the money with the thought that the writer from the UK, in hiding from Syria was MI6!

You completely nailed it!

As for the garden. I got one and it is work but worth it.

Right now I have beets frozen for winter and zucchini, I am going to freeze more. (bought a vacuum sealer to help out)

Cucumbers, So far this week I think we have picked about 25 of them, way to much for us. So we have been giving them away. THere will be more in another couple days.

I did find a delicious recipe for zucchini pancakes!

And yes, compost helps alot!

hi Penny

no, I missed your note. I shall go have a Bo Peep. Thanks for letting me know

Hi Penny, Great work you are

Hi Penny,

Great work you are doing on your blog! I don't often comment but I am always reading and learning, Thanks.

Did you read about Steve's bathroom break in Brazil ?

and that obnoxious buffoon Baird expelling the Libyan diplomats from Canada. What an embarrassment our government is.

and that obnoxious buffoon Baird expelling the Libyan diplomats from Canada. What an embarrassment our government is.

"Baird visited the Libyan rebel stronghold of Benghazi in June to meet with members of the National Transitional Council, a collection of mainly lawyers and academics."

Bet he was right at home among that crowd.

...............

We dill our cucumbers or make relish. There is nothing like a good homemade dill pickle. Yum... You need to use pickling cukes, which are also fine for fresh eating.

stevie's bathroom break

Oh that is rich!

For the "regular reasons"

Some people regularly go into the washroom to use drugs..

Is that what they mean

I did see Baird's idiocy on display, for the umpteenpth million time.

I did a post on it. It was timed to nicely coincide with Britian doing the same thing...

All very calculated.

I haven't attempted pickles at this time and right now we grow the wrong kind for that, but, one day I will get more ambitious.

I freeze most stuff, Tomatoes, Beets. I will bread/fry a bunch of eggplant then freeze that for eggplant parmesan, which freezes really well in this manner, and is super easy to use afterwards.

No need to have delicious eggplant parmesan at a restaurant when it can be made quickly and easily at home.

bathrooms and gardens

"Some people regularly go into the washroom to use drugs..

Is that what they mean"

Pickles are easy and so tasty when you do your own. Your eggplant idea sounds great. I've been toying with the idea of adding a diet/health/gardening section to our forum. Something like a healthy, earth friendly living kinda of an idea. I do a lot of reading on these subjects and I believe it is a very important component in our overall struggle for truth and sanity. Like everything else in our world the paths have been massively lying to us on issues of our diet and health.

Like everything else in our world the paths have been massively lying to us on issues of our diet and health.

for bugs

njt:

the humidity has taken a toll on our zucchini plants and they have collapsed. they get "wilt"

We don't use pesticides, we do spray with soapy water, sometime with cayenne pepper to deter critters

In a pressure sprayer. Breathe carefully when applying it can take your breath away.

Thanks Penny & McJ

I will give the soapy water a try tonight.

I did also find that as a suggested remedy on a few other blogs but there was so much information I became overwhelmed and didn't do anything about them yet.

And thanks for the interesting links McJ. Interesting times, these are...

Europe’s Short-Sale Bans May Fail to Reverse Stock Slide

Europe’s Short-Sale Bans May Fail to Reverse Stock Slide

http://www.bloomberg.com/news/2011-08-11/france-spain-italy-belgium-ban-...

"France, Spain, Italy and Belgium’s bans on short-selling may fail to reverse the fall in financial stocks and instead may concentrate bets against banks elsewhere in Europe, according to lawyers, investors and academics."

(Do they notice they are admitting that short selling is betting? On second thought, I'm sure they wouldn't give a shit who thinks there may be something wrong with this.)

On second thought, I'm sure they wouldn't give a shit who thinks there may be something wrong with this.)

This article is all about how banning short selling is not going to work. Methinks there are some anxious bankers and investors out there.

"The problem with a partial ban -- which is what we have now -- is that it moves the problem to other parts of the system,”

Is this true? (I wonder if this guy is aware that he's saying short selling is a problem.)

The obvious solution to this one is to make it a total ban...problem solved. Can I get the big bucks now, for the advise?

Can I get the big bucks now, for the advise?

Blood in the water

Yes, of course, McJ. Who shall i make the cheque out to? Top find, btw!

Top find, btw!

If Bloombergs are publishing an article saying it won't work and all the talking heads quoted are singing the same song, then i think it is reasonable for the casual but intelligent reader to assume that it will work, indeed. A lot of the wording in the article is very misleading and deceptive

"The problem with a partial ban -- which is what we have now -- is that it moves the problem to other parts of the system,”

Is this true? (I wonder if this guy is aware that he's saying short selling is a problem.)

Yes it is true in the sense that short sellers will look elsewhere for shorting opportunities. But if these short sellers are specifically targeting European banks (which it seems they are) then that specific problem has no where else to go.

These short sellers will be the big hedge funds of New York and London which have a preponderance of Jewish bankers behind them. And Bloombergs speaks for these people. So they have been checkmated for the time being. Meanwhile the European bankers' move through their respective governments to ban short selling highlights the essential problem involved. And as you pointed out, McJ, their opponents through their squealing have further exposed this problem. And it is a problem. And it is staring everyone in the face.

These markets are supposed to be for investors buying and selling their investments. They are NOT designed for speculators to sell shares they do not have and justify it by saying they are 'correcting the price' for everyone's else's benefit. It's bizarre logic even by their own mantra of supply and demand setting the correct price in the market place. How can that happen when some one can create infinite supply at no cost and pour it into the market?

Not that i have any sympathy for the Euro banks. They have known all along that it is a problem. They have implemented this ban to save their own skins. They've had years to do it and could have saved a lot of relatively ordinary people a lot of money and grief. No doubt, these same banks were amongst the sharks preying on these same people.

The thing is, if you are going to swim with the sharks, you have to make sure you are the biggest shark in the pool and/or be able to trust your fellow sharks.

I think the moral is clear

Feeding frenzy

"The thing is, if you are going to swim with the sharks, you have to make sure you are the biggest shark in the pool and/or be able to trust your fellow sharks."

The sharks are attacking each other. Specifically, Wall Street/Canary Wharf (the US/UK Investment banks - Goldman Sachs, JP Morgan Chase etc.) are attacking the European banks. (Jews against the European Aristocracy?? - probably not that simple, eh ).

).

Max Keiser:

http://rt.com/news/finance-war-usa-banks/

“The US investment banks and the rating agencies are now attacking these French banks. They know where the bodies are buried, and they are using the weapons they sold them to attack them,” he said. “The rating will be downgraded again. This is part of a new era on Wall Street – they go after sovereign debt. Wall Street and rating agencies are working together to destabilize the sovereign debt of these countries,” he added."

"Société Générale and BNP and Credit Agricole are insolvent. Their balance sheets are 6 -10 times bigger in terms of the debt that they carry than they could possibly service but it's carried on the shadow banking system. They don't report this debt but the insiders around the world, who wield the weapons of mass financial destruction, know where the bodies are buried and they are attacking them to force these unrealized debts onto their balance sheets - to force these companies into delinquency."

New York Times:

http://www.nytimes.com/2011/08/13/business/global/global-worries-about-t...

"Société Générale is one of the biggest global players in equity derivatives...It does business regularly with the likes of Goldman Sachs, JPMorgan Chase and Deutsche Bank. They have significant outstanding derivative exposures..."

So, the Wall Street/Canary Wharf Gangsters know the banks are insolvent because they sold them all the toxic financial instruments they are holding (and have been trying to hide). They use the ratings agencies to downgrade a country's sovereign debt, as in the case of Greece, which causes volatility (ie. panic) in the market.

"Investors’ main fear is that the company’s exposure to Greece — it even owns the majority of a Greek bank — and other troubled European countries..."

This forces these European banks' exposure to derivatives out of the shadows and onto their books - ('blood in the water' leading to a feeding frenzy). The banks/countries that are being attacked, counter by banning short selling because the short selling is basically the Wall Street/Canary Wharf gangsters cashing in on the panic (that they have been actively engineering) by betting the banks will fail? Aaargh - trying to wrap my mind around this.

"The sovereign debt of most of those other countries has recently been downgraded, hitting the bank’s portfolio."

"...on Friday, Société Générale’s stock has fallen more than 40 percent since mid-July and helped pull European bank stocks down earlier in the week. That volatility is a big reason that France on Thursday night imposed a temporary 15-day ban on short-selling..."

Back to Max:

“The volatility was the goal; by downgrading the rating you create volatility,” he explained. “The derivatives’ volume this week is exploding higher than any week in history. That is making many people on Wall Street and in the City of London very rich. So they will continue to downgrade and to milk the system to extract wealth,” Keiser stated."

Shark fin soup

The sharks are attacking each other. Specifically, Wall Street/Canary Wharf (the US/UK Investment banks - Goldman Sachs, JP Morgan Chase etc.) are attacking the European banks. (Jews against the European Aristocracy?? - probably not that simple, eh smiling).

Au contraire, ma chere. I think it is pretty much as simple as that.

You can see how the DSK/IMF business played a major part in this. If the original IMF plan for Ireland and Greece had gone ahead, i doubt this would have allowed the downgrading of those countries debts. The ratings agency S&P were the key to making the mortgage securities scam work in the US. They have ZERO credibility.

The rothschilds in recent years have consolidated their French branch of the business with English side. I had wondered why in the past. Perhaps they were using that as cover for selling out their interests in banks that are now being attacked. Just a guess but it would fit very well.

I haven't watched the RT video yet. Thanks for bring all this to our attention, McJ

Good point about the DSK/IMF

Good point about the DSK/IMF business. It makes a lot more sense now.

"The ratings agency S&P were the key to making the mortgage securities scam work in the US. They have ZERO credibility."

Well, it looks like there was some insider trading going on the day of the downgrade.

Somebody made huge money on S&P downgrade of US

http://rt.com/news/sp-downgrade-us-denninger/

"The US Security and Exchange commission is now investigating the Standard & Poor’s Rating Agency over allegations of insider trading before America's rating change was officially announced."

S & P had been threatening for some months to downgrade the US with an agenda that appears politically motivated, saying the US AAA rating relied on cuts to medicare and social security (nothing about the Bush tax cuts, the wars or private health care costs).

And there is this:

“Is Standard and Poor’s Manipulating US Debt Rating to Escape Liability for the Mortgage Crisis?”

http://www.nakedcapitalism.com/2011/07/is-standard-and-poor%e2%80%99s-ma...

on April 13: A bipartisan study on the financial crisis from the Coburn-Levin Senate Permanent Subcommittee on Investigations released a report saying the credit ratings agencies were a “key cause” of the financial crisis. They issued a 650 page report, which included the following recommendation (p. 16):

The SEC should use its regulatory authority to facilitate the ability of investors to hold credit ratings agencies accountable in civil lawsuits for inflated credit ratings, when a credit rating agency knowingly or recklessly fails to conduct a reasonable investigation of the rated security.

Two days later, David Beers reached out to Undersecretary Goldstein to let Treasury know that the Standard and Poors committee has changed its outlook to “negative.” On April 18: Standard and Poors issued press release downgrading the outlook for US sovereign debt from stable to negative and giving a 30% chance of a ratings downgrade from AAA to AA.

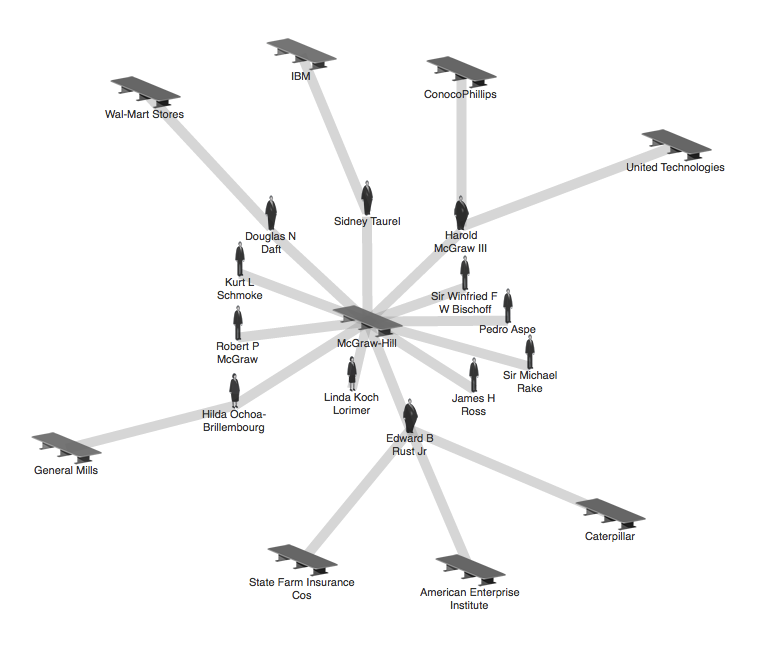

S & P is owned by McGraw Hill who are long time intimates of the Bush family.

http://spitfirelist.com/news/mcgraw-family-owners-of-s-p-are-longtime-in...

"McGraw Family (Owners of S & P) are Longtime Intimates of the Bush Family

Posted by Dave Emory ⋅ August 9, 2011

COMMENT: Standard and Poor’s is owned by publishing giant McGraw-Hill. In the wake of S & P’s downgrade of U.S. bonds’ rating from AAA (for the first time in history), it comes as no great surprise that the McGraw family are long time associates of the “Family of Secrets.”

This multi-generational association goes back to the 1930’s, when Joseph and Permelia Pryor Reed (daughter of Bush/Walker associate Samuel Pryor), established Jupiter Island as a playground for the Northeastern power elite.

McGraw-Hill chief Deven Sharma worked for Dresser Industries, now a division of Halliburton and a long time jewel in the Bush/Harriman corporate tiara. Dresser was George H.W. Bush’s first real job after his graduation from Yale.

One must wonder, also, who was the “mystery investor” who made the better part of a $billion on the downgrade?

The SEC is investigating the matter. It remains to be seen if anything substantive emerges from the investigation.

Similar profiteering took place upon the occasions of the JFK assassination and 9/11. The Bush milieu was deeply involved in the events of 11/22/1963 and 9/11/2001.

“Reading Between the Lines” by Stephen Metcalf; The Nation; 1/10/2002.

http://www.thenation.com/print/article/reading-between-lines

EXCERPT: . . . . While critics of the Bush Administration’s energy policies have pointed repeatedly to its intimacy with the oil and gas industry–specifically the now-imploding Enron–few education critics have noted the Administration’s cozy relationship with McGraw-Hill. At its heart lies the three-generation social mingling between the McGraw and Bush families. The McGraws are old Bush friends, dating back to the 1930s, when Joseph and Permelia Pryor Reed began to establish Jupiter Island, a barrier island off the coast of Florida, as a haven for the Northeast wealthy. The island’s original roster of socialite vacationers reads like a who’s who of American industry, finance and government: the Meads, the Mellons, the Paysons, the Whitneys, the Lovetts, the Harrimans–and Prescott Bush and James McGraw Jr. The generations of the two families parallel each other closely in age: the patriarchs Prescott and James Jr., son George and nephew Harold Jr., and grandson George W. and grandnephew Harold III, who now runs the family publishing empire.

The amount of cross-pollination and mutual admiration between the Administration and that empire is striking: Harold McGraw Jr. sits on the national grant advisory and founding board of the Barbara Bush Foundation for Family Literacy. McGraw in turn received the highest literacy award from President Bush in the early 1990s, for his contributions to the cause of literacy. The McGraw Foundation awarded current Bush Education Secretary Rod Paige its highest educator’s award while Paige was Houston’s school chief; Paige, in turn, was the keynote speaker at McGraw-Hill’s “government initiatives” conference last spring. Harold McGraw III was selected as a member of President George W. Bush’s transition advisory team, along with McGraw-Hill board member Edward Rust Jr., the CEO of State Farm and an active member of the Business Roundtable on educational issues. An ex-chief of staff for Barbara Bush is returning to work for Laura Bush in the White House–after a stint with McGraw-Hill as a media relations executive. John Negroponte left his position as McGraw-Hill’s executive vice president for global markets to become Bush’s ambassador to the United Nations. . . ."

McGraw-Hill owns Standards and Poors. McGraw-Hill is owned by:

Biography of Directors of McGraw Hill - http://www.mcgraw-hill.com/2011mhpproxy/statement.html#toc72457_3

McGraw Hill

Isn't that all very interesting!

The psychos are really an incestuous lot...

Which makes sense as it contributes to their psychotic-ness..

I got the impression the down grade was a political ploy.

To cause fear in the sheeple, to get them to willingly accept the cuts to the benefits they fully paid for!

You know everyone is feeling the pain...

Do you think the masses realize this is class warfare?

Spain is issuing IOU's to pay it's defense budget

Spain is issuing IOU's to pay it's defense budget. California also issued IOU's for bills it couldn't pay. Is this effectively the same as creating their own money? An IOU is a promise to pay, same as paper money. Could the IOU's be traded, same as $$'s? And could there be seigniorage involved dependent on the actual $$ value of the IOU when it is issued and when it is redeemed? Ie. if the $$ value is lower when the IOU is redeemed than when it was issued, the state/country would realize a profit (seigniorage)??

Spain Cannot Pay €26 Billion Defense Budget, Effectively Issues IOUs to Keep Within Stated Austerity Measures

http://globaleconomicanalysis.blogspot.com/2011/08/spain-cannot-pay-26-b...

Just musing about this money thing....

IOU's & Money

McJ, I don't know what form of IOU the Spanish govt is using but all money is an IOU. Perhaps they are issuing Treasury Bills (which are IOU's) directly to creditors instead of the usual practice of issuing the Treasury Bills to banks who exchange them for their fiat money (another IOU) for the govt to then hand to their creditors. The govts of the world incur an added cost in the form of interest payable to the banks when they exchange IOU's in this manner. This is the essence of the scam behind banks issuing money.

I'll use your question if I may, McJ, to lay out some basic ideas for readers about money that are easily forgotten in the myths that are woven around us everyday.

Fiat money then is an IOU formerly backed by the issuer (usually a privately owned bank) with another IOU that looks exactly the same! That is why some people don't like it. But ultimately, the fiat currency is actually backed by other citizens who will trade commodities for it and thus give the IOU/money it's value. So it's a confidence thing as mentioned in McJ's comment below.

Non-fiat money on issue that is backed by a promise to redeem for gold is still an IOU and is still dependent on confidence that it will be redeemed. It is only a promise after all.

When i was very young, Australian Pound notes could be redeemed at the local bank for gold "Sovereigns" - a gold coin which had a value of One Pound, surprisingly enough. So we had a gold backed currency. Or so the govt said, anyway. It wasn't really. It only gave the illusion of being 'gold backed' because there was only enough gold to redeem a small proportion of the money (bank notes) on issue. So again it was a confidence thing.

Even gold coins themselves require this confidence by the public to function as money. The person accepting the gold (be it a coin or otherwise) for goods or services rendered needs to be confident that someone else will do likewise when he wants to buy food, for instance. You can't feed your children gold and expect them to thrive. Gold itself has limited uses and there are many instances where it is indeed quite useless just as paper (fiat) money is.

So all money is backed by, and given value by, the people who use it for trade; not the government, not the issuing banks and not even the gold it can be exchanged for. So if the citizens of a country are collectively giving the currency it's value, they should reap the benefits that come from it's issuance and not be paying interest for it. This is another essential part of the whole money scam.

What makes anything money, be it gold, silver, paper, rum or conch shells, is the willingness of people to see it as such and trade things of value for it.

Sometimes that willingness is given grudgingly as when a govt requires you to obtain this money to pay your taxes or suffer the pain of imprisonment. That is ultimately how the use of exploitative money systems are enforced and you can see why issuing banks need governments to carry off their fraudulent systems.

Again, I hope this helps some readers rather than insulting them. It may help some to not fall for the attraction of the next scam that is going to be presented to us - a gold backed currency be it a One World Currency or otherwise.

When the sovereign falls

When the sovereign falls: Is this the endgame for world markets?

http://resourceinsights.blogspot.com/2011/08/when-sovereign-falls-is-thi...

"The downgrade of U.S. government debt by one ratings agency was more political theater than careful, cold calculation. U.S. Treasury bonds rallied on the news. But in France it is a different matter. French banks are known to be heavily exposed to the sovereign debt of what are now infamously called the PIIGS, that is, Portugal, Ireland, Italy, Greece and Spain. What changed this week was that market participants began to think that this matters. They think the problem is so big that it could impair the credit of the French government which will ultimately be saddled with cleaning up the mess. And, who wants to stick around for that?

Nicole Foss, part of the duo who write for the popular financial site The Automatic Earth, once explained to me that liquidity and confidence are the same thing. Liquidity means I'm willing to part with my cash to lend it to you or to buy something from you. When my confidence in you is shattered, I won't lend to you. When my confidence in my own future prospects is shattered, I won't buy from you because I think I may need the cash later. That, it seems, is where much of the world finds itself today.

But the problem for French banks isn't necessarily that they are in worse shape than many other banks in the world. It's that people believe this to be so. And, as that belief spreads, it will become a self-fulfilling prophesy. At first, one, then two, then 10, then 20 banks and so on will refuse to lend to French banks. And, with each withdrawal of a source of funds French banks will become less creditworthy.

But if this loss of confidence isn't stopped soon, it will spread to non-French banks that have large financial ties to French banks. A cascade of financial ruin will be unleashed. We have built of world of huge financial institutions with heavily incestuous relations. They are like rafts all strapped together which doesn't help much if all the rafts are sinking. "

On Liquidity

Liquidity, which loosely translates as how much money there seems to be about, is a product of the amount of money on issue (the Money Supply) and its "velocity" i.e. how fast it is being used in trade.

Velocity is measured by how many times the whole money supply turns over in one year. It normally hovers around 1 times. In boom times it will go up to 1.1 times and in depressed times down to 0.9. So it can easily vary 20% though sentiment. But this sentiment is in response to the effects of the shrinking of the money supply by the banks in the first place.

It is interesting to note at this point that the GDP of a country, the amount of production for a given year in a country, is equal to this figure of Money Supply multiplied by Velocity. The reason they are equal to each other is because GDP is a direct consequence of the money available to buy this production.

The banks shrink it by not issuing new loans at the same rate as old loans are being paid off. So new money is created at a lower rate that money is being extinguished (for want of a better word!). It is a very simple mechanism for controlling and exploiting our economies and it is further exacerbated by public sentiment or psychology.

Anyone who understands the above two points knows more about the true functioning of an economy than most graduates with economics degrees. The reason being is that this and the consequences of it is not taught in their degree courses.

So 'Liquidity' is a function of both public and corporate confidence together with banking connivance in increasing or decreasing the amount of money in circulation.

The whole banking system is ultimately hot air because the thing that makes anything money only exists in peoples minds and their willingness to play along and their confidence that others will continue to play, too

Lehman Bros was brought down by other banks taking the lead of the Fed and the SEC, refusing to extend them credit. Lehman Bros were cut out of the system or thrown off the 'raft' to use the metaphor in the quoted article. Other banks stopped playing the game. People then lost confidence and the end result was a certainty. ANY bank will fail if subjected to that.

On Ratings Agencies

A big part in company downfalls is played by the credit rating agencies (CRA's)and they have become very predatory and are rapidly destroying their reputation which means their businesses are ultimately being destroyed (bloody good thing!). If it weren't for Govt and Fed requirements that companies obtain ratings from these CRU's, they'd be out of business. Again we see Govt regulation forcing corrupt systems down people's throats.

Here's how Moody's (one of the big three CRA's along with S&P's and Fitch Ratings) operates.

http://www.mcclatchydc.com/2009/10/18/77244/how-moodys-sold-its-ratings-...

The point that isn't covered in this very good article is that the corruption of Moody's practices was deliberate.

You get what you pay for and the remuneration scheme was changed to push for maximising profits which means cashing in their reputations for short term gain but long term loss. So the owners being aware of this surely were looking to make even greater gains than these very predictable long term losses. So this looks like an Endrun Gambit to me.

These greater gains were very presumably through insider trading, that's mentioned, and through taking out derivative positions (along with others in the Hedge Funds) betting on the collapse of the companies they downgraded. Now they are targeting European banks and whole countries' economies that they are simultaneously being downgraded. Massive amounts of Credit Default Swaps and presumably any other derivative they can think of are being taken out on these targets together with short selling market campaigns.

Massive crimes are being perpetrated against hundreds of millions of people.

Here's a very good example of how they are now operating and blackmailing companies. You'll get the essence of their thinking through this

http://www.washingtonpost.com/wp-dyn/articles/A8032-2004Nov23.html

information overload :)

Reading you guys is always an education. Thank you.

A couple of questions: What will the powers that be get from destablizing more of Europe(via their banks), is it more control, closer to NWO, or just plain get richer(which of course translates to more power)?

How do some/any of you think the London/English riots were a part of all this?

Hi Debbieanne, A couple of

Hi Debbieanne,

A couple of questions: What will the powers that be get from destablizing more of Europe(via their banks), is it more control, closer to NWO, or just plain get richer(which of course translates to more power)?

All of the above plus a consolidation of power at the highest level. Less banks means more power for the remaining banks. It is continuing the pattern of 'the usual suspects' of turning on their allies.

How do some/any of you think the London/English riots were a part of all this?

Myself, i haven't followed the riots closely, but unemployment is deliberately and simply created by the banks who are behind governments and the push for the NWO.

So it's reasonable to presume the genuine rioters are reacting to that fundamental cause unemployment and the poverty that comes from that.

I have no doubt that the riots were exacerbated, if not initiated, by goverment security agencies for the purposes of creating more fear in the community so as to bring in more repressive laws to take away even more freedom from average citizens. All moving us (they hope) to accept a NWO scenario

thanks

Thanks very much. James.

Thanks James for your informative comments

Thanks James for your informative comments! And apologies for not getting back to this earlier. The harvest is overwhelming me.

"The govts of the world incur an added cost in the form of interest payable to the banks when they exchange IOU's in this manner. This is the essence of the scam behind banks issuing money.

...

Fiat money then is an IOU formerly backed by the issuer (usually a privately owned bank) with another IOU that looks exactly the same! That is why some people don't like it. But ultimately, the fiat currency is actually backed by other citizens who will trade commodities for it and thus give the IOU/money it's value. ...

Non-fiat money on issue that is backed by a promise to redeem for gold is still an IOU and is still dependent on confidence that it will be redeemed. It is only a promise after all. "

If national governments or states etc. issue IOU's/currency are they still 'effectively' borrowing it from private bankers because ultimately it is redeemable in $$'s (or whatever other national currency)? If the people of California (as an example) trade amongst themselves in their IOUs/currency, therefore creating confidence in it, wouldn't they effectively be cutting out the private banks (ie Fed)? There would be profit/loss in this dependant upon the $$ value of the IOU when it is issued and when it is redeemed? And they wouldn't be charging themselves interest on the IOU's? Probably too many questions. I'm just trying to understand the rational of doing this. Are they just delaying the inevitable?

Struggling US towns print their own currency

If you're fresh out of dollars, perhaps a Detroit Cheer, Bay Back or BerkShare will do.

http://www.telegraph.co.uk/news/worldnews/northamerica/usa/5126185/Strug...

IOU's and increasing the Money Supply

hi McJ, first off, a typo - Fiat money then is an IOU formerly backed by the issuer should read, "Fiat money then is an IOU formally backed by the issuer"

Reading it all again, i can see i haven't been as clear as I might have been.

If national governments or states etc. issue IOU's/currency are they still 'effectively' borrowing it from private bankers because ultimately it is redeemable in $$'s (or whatever other national currency)?

It depends on how they go about it. If they redeem all their IOU's for the Feds' money, then 'yes' is the answer. They are still borrowing from the Fed and are putting off the inevitable as you mentioned in a slightly different context.

If the govt. simply redeems those that people insist on, then the answer is partially, 'no'.

If the govt. does not redeem the IOU's for the Fed's money at all but says these IOU's are acceptable for paying your taxes with (which gives them guaranteed value) then the answer is absolutely, 'no'. They are not borrowing money from the Fed. This was the "Greenback" situation effectively.

The two strategies that do not redeem in full or at all, effectively increase the amount of money in circulation and therefore increase the amount of production or wealth creation. Which is exactly what we want.

The option of redeeming the IOU's in full with Fed money does not increase the amount of money except for that amount that is in transition between issue and redemption at any given time. i.e. the notes in peoples hands and not in any account because that would mean redemption.

The "BerkShare" money doesn't even get the benefit of increasing the money supply by the notes in peoples pockets because they are effectively 'redeemed' at the time they are issued because people have to pay over their bank money to get the community money at the beginning. So there is no increase in the money of any stripe in circulation because as one is issued, another is taken out of circulation. So these community schemes like Berkshares are of limited benefit in the particular way they all seem to do it.

If the people of California (as an example) trade amongst themselves in their IOUs/currency, therefore creating confidence in it, wouldn't they effectively be cutting out the private banks (ie Fed)?

It depends on how and what they are actually doing (and I'm going to have to find out!) but if they continue to trade in them and there is "bank facility" where accounts can be kept in the IOU's, then 'yes' they would indeed be cutting the Fed out and increasing the money supply which increases the economic activity.

There would be profit/loss in this dependant upon the $$ value of the IOU when it is issued and when it is redeemed?

As i said i'll have to find out what California is actually doing. The Berkshare example does suffer an initial loss because the face value is discounted. But presumably the organisers invest the Fed money that is handed over for the Berkshares and gain interest back on it to offset the discount they offer on their own community money, the Berkshares.

There is a simple way to do it right but i haven't come across anyone who is doing it this way yet. Understanding why is it simple is not so simple, though!

Perhaps a short post is in order.

That helps a lot.

That helps a lot. Thanks. I was thinking the only way this could work is if they have their own bank(s)/accounting for the IOU's and if they are not traded in/redeemed for dollars.

RE: California - I know that they are issuing income tax refunds in IOU's. I just can't remember what other things off the top of my head.

Delaying the inevitable

Delaying the inevitable....

http://www.sco.ca.gov/eo_news_registeredwarrants.html

"Without action by the Governor and Legislature to stave off a severe cash deficit, the Controller was forced to issue individual registered warrants, also called IOUs, beginning July 2, 2009.

Payment delays, like those used in February to manage a smaller cash crisis, will not provide sufficient resources to meet the State’s obligations.

A registered warrant is a “promise to pay,” with interest, that is issued by the State when there is not enough cash to meet all of the State’s payment obligations.

If there is sufficient cash available, registered warrants, or IOUs, will be paid by the State Treasurer on October 2, 2009. If the Pooled Money Investment Board (PMIB) determines there is sufficient cash available for redemption at an earlier date, they may be redeemed earlier than October 2, 2009. These IOUs are issued in the place of regular warrants, or checks. The interest rate, set by the PMIB on July 2, 2009, is 3.75% per year.

The State Constitution, federal law and court orders protect education, debt service, state payroll, pensions, In-Home Supportive Services and Medi-Cal providers. In July, those payments will be made with regular, or “normal,” warrants.

However, due to the cash shortage, the State has no alternative but to issue registered warrants, or IOUs, to private businesses, local governments, taxpayers receiving income tax refunds and owners of unclaimed property.

The Controller's office produced a chart illustrating the severity of the cash deficit and why the State was being forced to issue IOUs. (Click on this link for a larger PDF version of the chart.)

Registered warrants are issued in the same manner as regular, or normal, pay warrants, and will be issued on the same day a normal warrant is scheduled to be issued. Registered warrants, or IOUs, are legal negotiable instruments that are paid with interest."

Or maybe not...

Colonial Finance Redux In The California Republic )

)

Posted on October 31, 2010

By: John Ford

http://currencycommonsvt.org/2010/10/colonial-finance-redux-in-the-calif...

(Good article, worth the read, I believe.

Snip:

California decided to get hip and get into the money issuing business, albeit for a short period of time, by issuing IOU registered warrants to pay state vendors and issue tax refunds to residents totaling $3 billion. And what do you do with a registered warrant? Well, you have a couple of options. One of the ways that a warrant functioned was like a post dated check. The state of California says sorry, but we are broke and here’s a warrant, but you will have to hold it until October of this year to get your money with interest of 3.75%. That’s if you can find a bank that is willing to redeem the warrant for US dollars, and many of them would not.

Supposing that you have a window cleaning business to clean windows in state buildings for $5000 per month and you soon find out that the checks not in the mail, and what you get instead was a warrant that’s going to get stuffed in your wallet until October. And meanwhile you have employees that need to be paid. Remember now, that according to the state Controller that warrant is a negotiable instrument meaning that it can be circulated by being endorsed by the original payee and can be redeemed by the bearer. So the first month you get paid with this warrant and realize you are pretty strapped for cash and so instead of stuffing that warrant in your wallet, you decide to endorse it over to a family member who has the cash and wouldn’t mind collecting the 3.75% interest on the warrant and gives you the cash for immediate use. (California would only pay the interest to the original payee and not to the bearer of the warrant) But suppose you didn’t need the cash and in fact you had a number of bills that needed to be paid to the state of California like your taxes for example, or tuition to a state college. Assembly Bill 1506 says “for the payment of any obligation owed by that payee to that state agency”. So you put a stamp on the envelope, endorse the warrant and send it off to the state of California. And voila, you have just stepped out of the matrix of the US dollar and into the strange new world of parallel currencies.

With the stroke of a pen you and the state of California have teamed up and gone into the money creation business engaged in the very same activity as the Colonial states and their bills of credit where they utilized essentially a parallel currency system. In parallel systems of exchange both you, the State and your piers always have more then one way of engaging in exchange. In the Colonial states, internal commerce was carried on with colonial scrip, while trade with other countries was gold coin. California, by utilizing registered warrants in 1992 and again in 2009 has morphed into an open source system of exchange that operates in its dual capacity in both US dollars and registered warrants. And although the warrants were intended simply as a stop-gap measure in a deficit crisis and were somewhat clumsy and limited in their application, they nevertheless fulfill the basic requirements necessary for a parallel currency system primarily due to the fact that the state accepts them as payment for taxes and fees, a measure that immediately imparts value to them, and that the warrants were intended to circulate between the state and the taxpayers and between individual citizens.

By taking the step to issue warrants, California has trespassed into the forbidden zone outlined in the Constitution regarding bill of credit where it states “…..no state shall coin Money; emit Bills of Credit; make any Thing but gold and silver Coin a Tender in Payment of Debts.” In Craig v. Missouri, 29 U.S. 410 (1830) the court reestablishes the definition of bills of credit outlining the differences between a bill of credit and a municipal bond where a bill of credit is a paper medium of exchange that circulates between citizens and citizens and government. And although California did not impart legal tender status to the warrants, they were clearly intended to circulate for ordinary purposes of exchange in society. If California were to embark on a more aggressive policy of issuing warrants then they would no longer be revenue constrained as are all non-sovereign governments and their deficit problems would be over. And they are over because the state of California in its capacity as a sovereign would become an issuer of money, no longer limited to raising revenue by taxing and borrowing. When the IOU warrants become functionally like a currency, the limitations of closed source systems and budget deficits no longer apply. A sovereign entity does not necessarily need to raise revenue before it can spend. Quite the contrary. In a sovereign credit system of finance the function of taxation is not limited to raising revenue. Taxation works to impart value to fiat currencies to secure their standing as a medium of exchange and to maintain an adequate velocity of this currency by keeping it moving out of the system. By invoking the power of seignorage (money creation) governments are Never revenue constrained, but act according to the primary fundamentals of economic stewardship that ensure that money works for the benefit of the citizens and not for the exclusive domain of a private financial cartel.

Warrants

Thanks for digging up those links, McJ.

The State of California used the Registered Warrants as short term bridging finance to cover a hole in their projected cashflow. So they were 'putting off the inevitable' in that the Warrants that were issued were redeemed for Fed dollars and so the increase in the money supply that the warrants represented was only short term.

So the Warrants were issued to solve a short term problem for the State Controllers Office but not for the long term problems for many citizens of California.

However it is paving the way for that eventuality later.

The second link is to a very good article, as you said, and looks towards that eventuality.

Without explicitly saying so, the author of that article paints a scenario that would come about if a state such as California were to keep issuing new Warrants as the old ones became due. So one short term increase in the effective money supply followed another so the overall effect is one long term indefinite issue of 'money'.

This is very close to what i would see as the ideal solution. Two critical conditions are the same. The first, that you highlighted, is that the govt of California accepts these warrants as suitable for paying debts to themselves giving them ongoing guaranteed value. And secondly, they are denominated in dollars, Fed dollars, and not "Community Dollars" or "Sunshine Shekels" or some such. This allows them to be circulated and accepted as equivalent to the Fed dollars. It also allows for a straight forward redemption rate.

A municipality could do exactly the same if it accepted their IOU's as payment for rates or other municipal fees. And there is an even simpler way to do it, i believe, than issuing instruments such as warrants. It would be by combining the above features I mentioned with a LETS Scheme.

A group of community organisations could do the same too if they could guarantee ongoing value. i.e. redemption in Fed dollars at any time in the future.

I think it has huge potential.

Italian Town Mints Own Money to Fight Austerity

A small town in central Italy is trying to go independent and mint its own money in protest at government austerity cuts.

http://www.cnbc.com//id/44322945

After Disaster Mints

Thanks very much for the link to this story, McJ. It has inspired me to do a post on it! Perhaps over the weekend.

American Social Credit: Belling the Rothschild Cat

There's a superb article by Washington State economist Dick Eastman that explains the monetary situation, and remedy, as well as any I've seen: search "Belling the Rothschild Cat".

Another part of the remedy involves curtailing corporate charters, which have grown absurdly permissive since the 1800s as various crafty businesspeople have shielded themselves behind corporations that assumed the status of "persons" with limited liability. Earlier on, corporations tended to have strictly defined 20-year charters, that would be renewed or not – depending on their behaviour!

Corporations, Eastman and C.H. Douglas

hi Chatterbox, yes, corporations have become major problems. Since they have a 'personhood' before the law, they can claim to being discriminated against. Yet, of course, they can't be jailed. I've looked at Eastman's article but I'm a bit brain dead at the moment and finding his diagrams a bit hard to follow in detail. So I'm reticent to comment at this stage. Does Eastman have any tie up with Able Danger?

C.H. Douglas' Social Credit is an extremely good idea. The nub of it if, IIRC, is that the money to finance production is loaned into the community via business loans and overdrafts and this goes to workers via wages etc. But the profit margin is not similarly financed, only the costs.

So there will always be a shortage of funds unless the workers/consumers borrow to cover the gap because their wages collectively don't add up in value to the retail prices. Douglas' idea was to provide for this gap with govt bonuses or dividends (by govt created 'social' credit at no interest) to the public to cover this gap between cost price and retail price and so balance the finances of the nation.

Hi James, Give the Dick

Hi James,

Give the Dick Eastman article( another go: he's pretty lucid all in all. No, he has no direct connection with Abel Danger: they're a largely decentralized intelligence group with I think 8000+ volunteer members (some obviously more active/credible/professional than others). I view the group largely as a high-quality clearinghouse; I'm guessing Dick Eastman's work has a few fans there. They are certainly a sincere and talented bunch; often brilliant (especially David Hawkins on audio).

another go: he's pretty lucid all in all. No, he has no direct connection with Abel Danger: they're a largely decentralized intelligence group with I think 8000+ volunteer members (some obviously more active/credible/professional than others). I view the group largely as a high-quality clearinghouse; I'm guessing Dick Eastman's work has a few fans there. They are certainly a sincere and talented bunch; often brilliant (especially David Hawkins on audio).

Eastman (with help from many contributors) has simplified and upgraded many of Douglas's insights; another generally excellent and related economist to explore is Arthur Kitson.

But one won't glean the available insights from AD, or from Eastman, without a bit of extra effort and concentration. Their work is so good (like Winter Patriot's!) that they trigger paradigm shifts in folks who are ready and open. It's good, empowering stuff.

Social Credit

After taking up Chatterbox's challenge, I found this site which looks like Dick Eastman's.

http://www.citizensamericaparty.org/

I've read quite a bit there and haven't found anything yet of any importance that I disagree with and a heap that i thoroughly do agree with including his treatment of gold.

Here's a lengthy article on Social Credit broken down into various questions. Well worth reading-

http://www.thespiritualun.org/socialcredit.htm

Post new comment